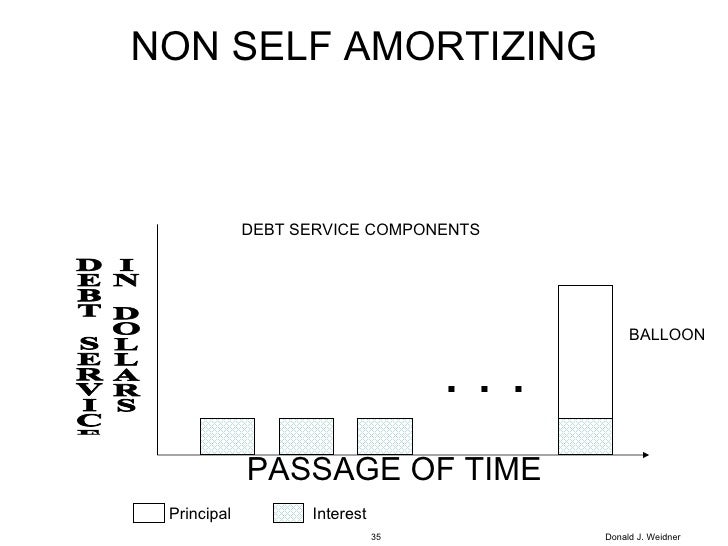

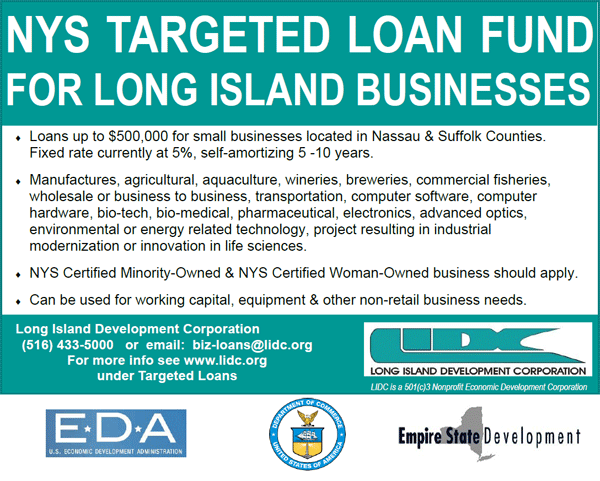

Self-Amortizing | Up to 30 years fixed and fully amortizing; Amortization refers to the reduction of a debt over time by paying the same amount each period, usually monthly. Free amortization calculator returns monthly payment as well as displaying a schedule, graph, and pie chart breakdown of an amortized loan. In finance, negative amortization (also known as negam, deferred interest or graduated payment mortgage) occurs whenever the loan payment for any period is less than the interest charged over. Amortized analysis is a tool for analyzing algorithms that perform a sequence of similar operations. Fannie/freddie multifamily loans from $750k and up; If you buy gnma or similar bonds, you get back part of your. Amortized analysis is a tool for analyzing algorithms that perform a sequence of similar operations. The loan is paid off at the end of the term. Amortization is a method for paying off both the principle of the mortgage loan and the interest in one fixed monthly payment. How to amortize a bond discount. Mortgage whose entire principal is paid off in a specified period of time with regular interest and principal payments. In finance, negative amortization (also known as negam, deferred interest or graduated payment mortgage) occurs whenever the loan payment for any period is less than the interest charged over. Mortgage whose entire principal is paid off in a specified period of time with regular interest and principal payments. Amortized analysis is a tool for analyzing algorithms that perform a sequence of similar operations. Company borrows $400,000 on 12/31/08 2. Fannie/freddie multifamily loans from $750k and up; A loan that is retired by the regular payment of fixed installments that cover the interest and principal amount. Amortization is a method for paying off both the principle of the mortgage loan and the interest in one fixed monthly payment. Or, simply learn more about loan amortization. Up to 30 years fixed and fully amortizing; The loan is paid off at the end of the term. Up to basic food groups for commercial property investors are self storage, assisted living, and hospitality. Up to 30 years fixed and fully amortizing; A loan that is retired by the regular payment of fixed installments that cover the interest and principal amount. If you buy gnma or similar bonds, you get back part of your. 10 percent annual rate of interest 3. Amortization involves paying down a loan with a series of fixed payments. Amortization refers to the reduction of a debt over time by paying the same amount each period, usually monthly. Use this amortization schedule calculator to estimate your monthly loan or mortgage repayments, and check a free amortization chart. Mortgage whose entire principal is paid off in a specified period of time with regular interest and principal payments. Mortgage whose entire principal is paid off in a specified period of time with regular interest and principal payments. Once all the payments are made, the loan is paid back. With amortization, the payment amount consists of both principal repayment and. How to amortize a bond discount. Up to basic food groups for commercial property investors are self storage, assisted living, and hospitality. The loan is paid off at the end of the term. Free amortization calculator returns monthly payment as well as displaying a schedule, graph, and pie chart breakdown of an amortized loan. Many are not synonyms or translations) Amortized analysis is a tool for analyzing algorithms that perform a sequence of similar operations. Up to 30 years fixed and fully amortizing; Amortization refers to the reduction of a debt over time by paying the same amount each period, usually monthly. Once all the payments are made, the loan is paid back. Amortization is a method for paying off both the principle of the mortgage loan and the interest in one fixed monthly payment. How to amortize a bond discount. Mortgage whose entire principal is paid off in a specified period of time with regular interest and principal payments. 10 percent annual rate of interest 3. Free amortization calculator returns monthly payment as well as displaying a schedule, graph, and pie chart breakdown of an amortized loan. Up to 30 years fixed and fully amortizing; Amortized analysis is a tool for analyzing algorithms that perform a sequence of similar operations. The easiest way to calculate payments on an amortized loan is to use a loan amortization calculator or tab. If you buy gnma or similar bonds, you get back part of your. Many are not synonyms or translations) A loan that is retired by the regular payment of fixed installments that cover the interest and principal amount. Amortization involves paying down a loan with a series of fixed payments. Company borrows $400,000 on 12/31/08 2. Amortization refers to the reduction of a debt over time by paying the same amount each period, usually monthly. Mortgage whose entire principal is paid off in a specified period of time with regular interest and principal payments. The loan is paid off at the end of the term.

Self-Amortizing: The easiest way to calculate payments on an amortized loan is to use a loan amortization calculator or tab.

Source: Self-Amortizing

0 Tanggapan:

Post a Comment